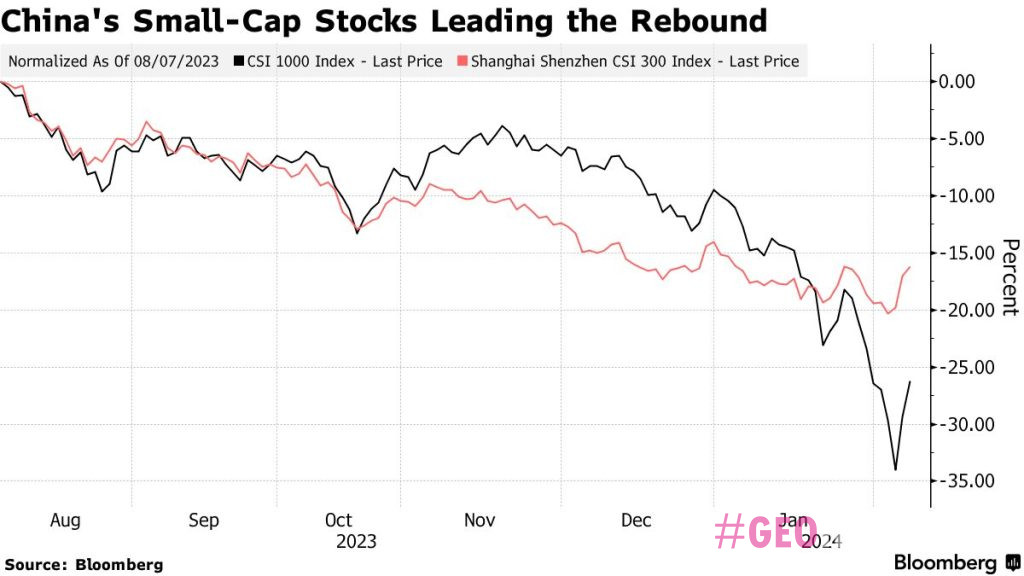

Chinese securities regulator changes leadership: last chance to cheer up the stock market. China's securities regulator has replaced its head in hopes of stemming the collapse in stocks. The surprise move, made under the watchful eye of Xi Jinping, expressed concern over the crisis gripping the market. Meanwhile, China's stock market is heading downhill.

Staff at China's top securities regulator have been working around the clock for weeks to try to support China's falling stock market, which lost more than $5 trillion. The official Xinhua News Agency on Wednesday evening announced the removal of Yi Huiman from office, the Communist Party's biggest casualty yet amid financial losses that have undermined confidence in China's economy among international investors.

Read also: China deploys long-range missiles near South Korea

The decision sent shockwaves through the China Securities Regulatory Commission, according to people familiar with the matter. Yi's departure came as a surprise even to senior officials at China's securities regulatory commission, underscoring the alarm within Xi Jinping's government about the crisis, which is now in its fourth year. Instead of Yi, Qing, a close ally of Prime Minister Li Qiang, takes over as the head of the regulator.

The China Securities Commission did not comment on the situation regarding the stock market

China experts note that these actions could be the beginning of new measures to stem the fall of the world's second largest economy. – China stock market. Restrictive measures taken last week failed to restore investor confidence.

“This step has been necessary for a long time. If one manager is not up to the task, it may be time to give another a chance. The new leader can take more decisive action rather than just words” – noted Managing Director of Zhuhai Greenbamboo Private Fund Management Jiang Liangqing.

Expectations for stronger action to stabilize China's stock market grew following Bloomberg's reports of Xi's upcoming market briefing. It is unclear what role Yi played in this.

Read also: Stagnation of the Batumi real estate market in autumn 2023

China's latest measures, including restrictions on short selling and stock purchases by state-owned enterprises, had some impact on the market, helping it rise for three days in a row. However “National team” China bought about 70 billion yuan worth of shares over the past month, which is not enough to fully restore confidence in China's stock market, according to Goldman Sachs Group Inc.

Government intervention could help interrupt the downward trend in the Chinese stock market

“Government intervention could help break the downtrend in China's stock market, but more systemic reforms and policy measures are needed to revalue China's stocks”, – analysts write Goldman Sachs. In the past, regulatory changes at the China Securities Regulatory Commission have caused China's stock market to rise, which may correct the market in this situation as well. But will this change the general trend? – very doubtful.

China's real estate crisis shows no signs of ending

However, major market interventions in China have rarely gone smoothly, and the country's economy faces greater challenges than during previous market downturns: China's real estate crisis shows no sign of ending, geopolitical tensions with the US continue to escalate, and foreign investors are wary of a government that suppresses private enterprise.

However, analysts note that the China Securities Regulatory Commission (CSRC) has limited ability to influence the market. She can't command “national team” or create stabilization funds and is largely dependent on other forces to stimulate economic growth.

China's stock market reflects weak growth and lack of confidence

The change of chairman of the China Securities Regulatory Commission, although a significant event, does not fundamentally change anything, economists say. As a result, China's stock market reflects weak growth and lack of confidence. Unless Beijing addresses these fundamental issues, the stock market is likely to continue to struggle.

Read also: Transfers from Russia to Georgia decreased by 5 times

Now the 58-year-old new chairman of the China Securities Regulatory Commission, Wu, faces a difficult task. He was appointed after serving as an adviser to the deputy party secretary in Shanghai and worked closely with Premier Li. Wu has extensive experience in financial regulation and is known as a man who strives for law and order.

The benchmark CSI 300 index has risen more than 40% in nearly two years since Liu Shiyu succeeded Xiao Gang in 2016. The rate jumped more than 80% in the two years after Liu was removed from office by Yi in 2019.

How to stabilize China's stock market?

While Wu's appointment may calm investors' nerves in the short term, addressing fundamental issues will require greater political effort to stabilize China's stock market. But it is unclear how the Chinese Communist Party will behave towards investors. This is precisely the basis of this crisis on the Chinese stock exchange.

Read also: BMW and VW are scaling back their ambitions in the electric vehicle market